|

Azalia Elev. Inc.

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Tilray Stock a Buy, Sell, or Hold for August 2025?

Cannabis stocks jumped hard in August 2025 after President Trump said his administration is considering reclassifying marijuana under federal law. The news sent the sector's stocks flying across the board: Tilray (TLRY) shot up 32% in one day, while industry names like Trulieve Cannabis (TRUL.CN) gained 35% and Curaleaf Holdings (CURLF) climbed 29%. Moving marijuana from Schedule I to Schedule III would make banking easier, cut tax burdens, open up more research possibilities, and give the whole industry more credibility. This matters because nearly 40 U.S. states already allow some form of cannabis use. The sector's ETFs tell the same story, with the Roundhill Cannabis ETF (WEED) jumping almost 30% in a single session. It shows just how much these stocks move when regulations might shift. Tilray sits right in the middle of this action as one of North America's biggest cannabis names. TLRY shares had been trading close to 50% below their recent peaks earlier this year, but they caught fire as investors started thinking about what federal reform could mean for the business. The stock moved fast as people tried to figure out how much this policy shift might help companies like Tilray. With momentum this strong, does Tilray have what it takes to keep the rally going, or are we looking at another quick spike that dies down once the headlines fade? Let's find out. Tilray’s 2025 Financial ScorecardTilray runs a business that stretches across cannabis, beverages, and wellness, with operations in medical and adult-use cannabis around the world, a big craft beer presence in the U.S., and a lineup of hemp wellness products. Over the last year, shares have fallen 44.3%, but things have flipped fast, up 129.3% in three months as policy news gives the stock some new life.

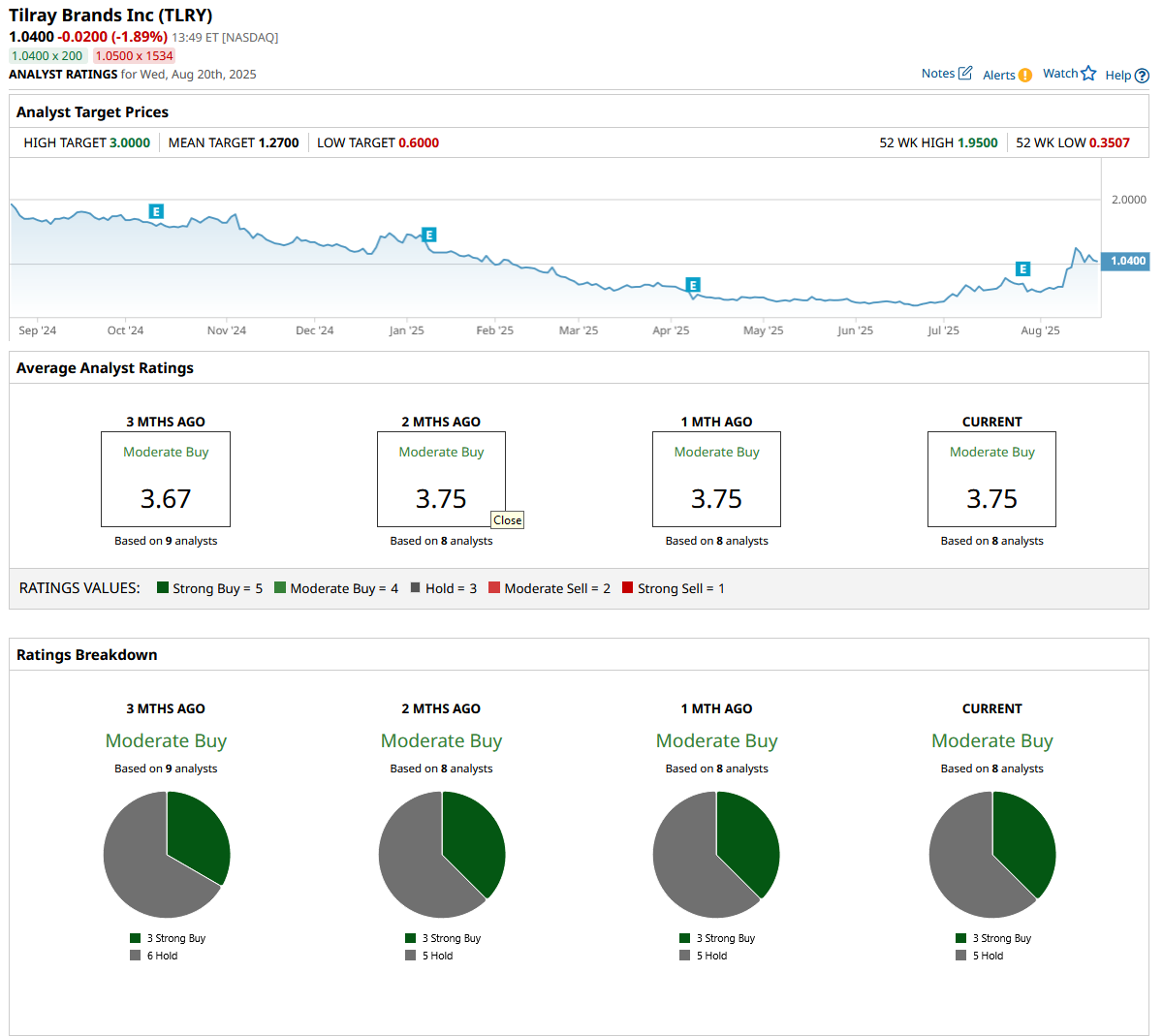

The market is pricing Tilray for bigger things, with its forward price-to-earnings (P/E) ratio at 25.75 compared to the sector’s 18, showing people are willing to pay more for its mix. Looking at the numbers, Tilray pulled in $224.5 million in net revenue last quarter, down from $229.9 million the year before. Gross margin sat at 30%, with gross profit at $67.6 million. Cannabis revenue dipped to $67.8 million as the company paused vapes and some pre-rolls and faced delays in international permits, but gross profit from cannabis moved up to $29.6 million. Beverage profit slipped to $25 million, distribution sales climbed to $74.1 million, and wellness hit $17 million. The net quarterly loss was $1,267.9 million, mostly from non-cash charges tied to older deals, but on an adjusted basis, there was $20.2 million in net income and $27.6 million of adjusted EBITDA. For all of 2025, revenue climbed 4% to $821.3 million, gross profit rose 8% to $240.6 million, and Tilray made progress reducing debt, with about $256.4 million in liquidity and roughly $100 million in repayments so far this year. What’s Powering Tilray’s Prospects?Tilray is focusing hard on Europe right now. In Italy, Tilray Medical’s FL Group teamed up with Molteni, a company known for its work in pain and addiction medicine, to help more patients access Tilray’s medical cannabis extracts. The real advantage isn’t just selling more products; it’s that Molteni’s large network of doctors and pharmacists can educate health professionals about using medical cannabis, which usually helps prescriptions grow and makes Tilray’s products better known among caregivers. On top of that, Tilray Medical became the first company picked by Italy’s Ministry of Health to bring in and sell its own brand of medical cannabis flower, starting with three new strains through FL Group. Being first gives Tilray a chance to build relationships with pharmacies, get patients familiar with their products, and set up a strong presence before others can follow. When you add the Molteni partnership and this early approval together, Tilray could grab a big piece of the Italian medical cannabis market as it develops. Outside Europe, Tilray Medical introduced Good Supply Pastilles in Australia, their first medical cannabis edibles there, which are sugar-free and vegan. This launch gives patients and doctors more choices, especially for those who don’t want to inhale cannabis. All these moves show Tilray is pushing ahead, using education, first-in-market products, and new product formats to grow its place in the global medical cannabis business. Analyst Verdicts and the Road Ahead for TLRYTilray has set some clear expectations for investors. The next earnings report is coming with an average EPS estimates of negative three cents for the current quarter, which would be a 25% improvement. For fiscal 2026, the company is aiming for adjusted EBITDA between $62 million and $72 million, which would be 13% to 31% higher than last year. Looking at analyst opinions, Pablo Zuanic at Zelman & Associates has kept a “Neutral” rating, calling for patience. He points out that the company’s track record is mixed, and the effect of possible U.S. regulatory changes is still up in the air. Many on Wall Street want to see if Tilray’s recent deals in places like Italy actually drive lasting profits instead of just making headlines. Right now, the mood from analysts is cautiously positive. Eight analysts give Tilray a “Moderate Buy” consensus, with an average price target of $1.27. With shares sitting at $1.03, there’s about 23% upside in their view. Tilray’s run after the cannabis reclassification headline is impressive, but this is still a show-me story. Yes, international partnerships and medical wins are great for the long term, and guidance signals improving business quality, but losses and volatility haven’t gone away just because sentiment flipped. Analysts see double-digit upside from here, but it’s a “Moderate Buy” for a reason: execution and real international profits, not just announcements, matter most. If you can stomach the volatility, this is one for the watchlist or a well-timed trade, not a “set and forget” play.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|